Emergency Loans

Comprehensive Guide to Emergency Loans: Fast Relief for Unexpected Expenses

Throughout your life, there might be times when you find yourself dealing with unexpected expenses, anything from a surprise medical bill to a sudden issue with your car or home. It could even be a family emergency that requires you to take time off from work and reduces your paycheck.

Whatever the case, if you do not have the cash on hand to handle these expenses, emergency loans could help. With a direct lender emergency loan, you can get the money you need to pay for these surprises quickly — sometimes the same day you apply. This can give you some much-needed peace of mind and more time to handle the unexpected without putting as much strain on your budget.

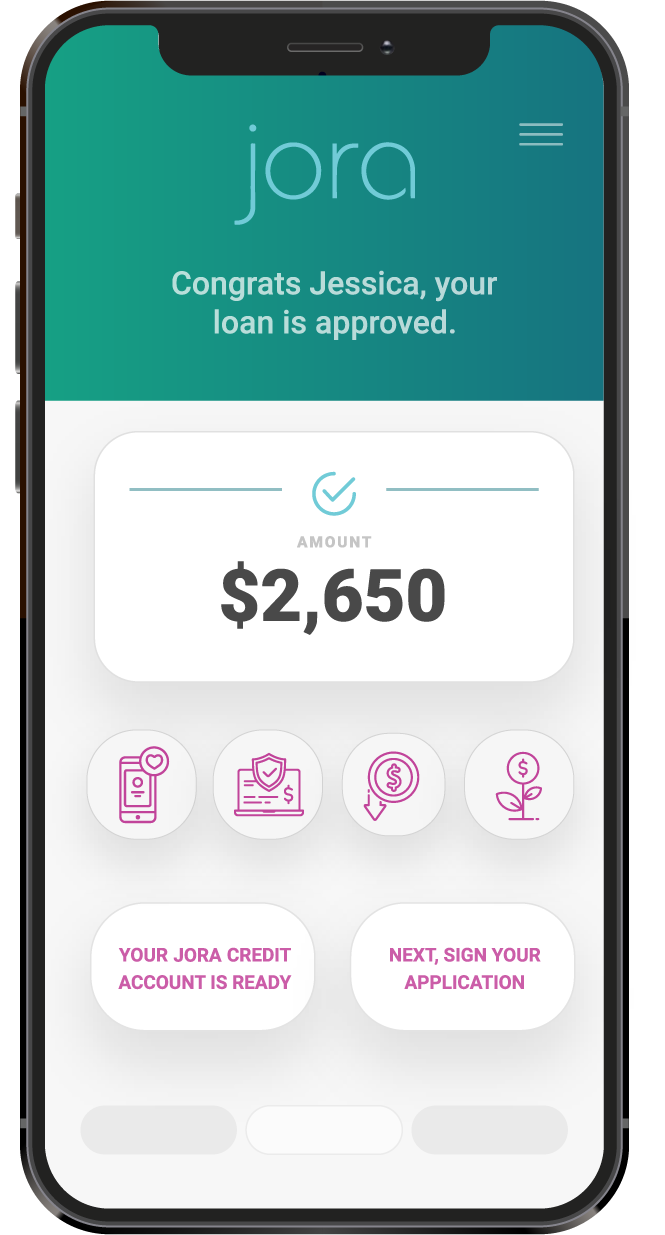

If you need a quick loan now, you can apply through Jora.

What Is an Emergency Loan?

Many different types of loans are out there, each with its own purpose, requirements, and terms. Emergency loans are personal loans designed to help with unplanned expenses. Most come with fast approval and funding times, meaning you can get the money you need now rather than waiting. These loans also generally have more lenient requirements than traditional financing solutions, making them easier to get.

Although all emergency loan direct lenders are different, many emergency loans come with longer repayment periods than, say, payday loans. With payday loans, you’ll typically have to pay back what you owe in a lump sum two to four weeks after taking it out. But with emergency loans, you might have several months or even years to repay the loan.

During the repayment period, you’ll still need to make regular payments on the emergency loan. These are called installments and tend to be for a fixed amount. For most borrowers, the extended repayment period makes it easier to manage the loan and pay it back on time.

As with most personal loans, including short-term loans and installment loans, your payments will typically include the principal and interest. If you make every payment on time, you can pay off the entire loan by the end of the repayment period. With some direct lenders, like Jora, you might be able to repay the loan sooner without a penalty to save you money in interest.

Emergency Loan Use Cases

There are many loan purposes for emergency loans. Some lenders might restrict how to use the money once you have it. However, most of these loans are flexible and can be used for nearly any reason, including:

- Home repairs: Installing a patio or updating your kitchen cabinetry might be things you can wait on, but certain home repairs are more time-sensitive. For example, if your roof is leaking, a major appliance has broken, or you have an infestation, you might need emergency money to fix it before incurring additional damages.

- Medical bills: Health-related expenses, including dental bills, could be cause for getting an emergency loan. This is especially true if your health insurance does not cover the total cost and the bill is due soon. With a loan, you can pay for the medical bill right away and then pay back what you borrowed over time.

- Car repairs: The average person spends $548.32 on vehicle repairs, a hefty price for those living paycheck to paycheck or with limited available funds. If you have a flat tire or need to take your car to the mechanic, you can cover the bill with an emergency loan.

- Travel or relocation: If you need to suddenly move or go somewhere, you can use the emergency loan to cover things like hotel accommodations, food, gas, and even airfare.

- Family emergencies: If a loved one has experienced a health-related emergency, you might need fast cash to help cover your expenses while you go take care of them. You could also use the money for other things like funeral arrangements.

- Job loss: Emergency loans and other direct cash lenders’ loans can also help in the event of a sudden layoff at work. You can use the money to cover some expenses until you find another source of income.

- Other necessary expenses: Your idea of an emergency expense might differ from someone else’s, but if you have a sudden or unforeseen expense, you can use an emergency loan to cover it.

Emergency Loans and Bad Credit: Can It Work?

Many lenders offer personal loans for bad credit — or bad credit personal loans — to borrowers who are not eligible for traditional credit. What this means is that you could still qualify for an emergency loan if you have less than stellar credit or even no credit at all.

Some common types of loans for bad credit include:

- Payday loan: Sometimes called “no credit check loans,” these loans are designed for people with bad credit. They come with minimal requirements and quick funding times. Unlike other personal loans, loan amounts are usually small — often around $500 — and must be repaid by the borrower’s next payday. You can get one from payday direct lenders online or at storefront locations.

- Home equity loan: Even with poor credit, you could qualify for a home equity loan if you own a home with equity. You can use the loan to cover emergency expenses. As with other loans, you’ll need to pay back what you borrowed plus interest. Failure to do so could result in losing your home.

- 401(k) emergency loan: If you have a 401(k) plan through your employer, you might be able to take out an emergency loan using the money in your account. You do not need good credit to qualify. The maximum loan amount is either $50,000 or 50% of your account balance — whichever is less.

- Paycheck advance: Depending on your employment situation, you might be able to get an advance on your paycheck — without a credit check. This can be helpful if you have an emergency bill or need some extra cash to get you to your next payday.

- Secured personal loan: Certain lenders offer secured personal loans — that is, any personal loan secured by collateral. If you do not repay the loan on time, the lender could take the collateral to recoup their money.

- Title loan: Title loans are short-term loans that use your vehicle as collateral in exchange for a small cash sum. These loans are easy to get and rarely require a credit check. However, they are secured loans, meaning failure to repay the loan could result in losing your vehicle.

- Friend and family cash loan: As the name suggests, these are cash loans you can get from a friend or family member. You’ll need to choose someone financially stable and with whom you have a good relationship. It’s also important to outline the terms and conditions of the loan so that everyone is on the same page.

- Unsecured installment loan online from direct lenders: Certain lenders, like Jora, offer installment loans to borrowers with poor or limited credit. You might need to meet specific income requirements to qualify.

Why Jora Credit?

Other Emergency Loan Requirements

Direct lender bad credit loan options, like emergency loans, come with different requirements. However, here are the most common loan requirements you’re likely to come across:

- Proof of income and/or employment: You’ll need to provide proof of income when applying for a loan so the lender knows you have the financial capability to repay the loan. Commonly accepted documents include bank statements, pay stubs, W-2s, and tax returns. If you are not employed, you could still qualify for a loan if you have an alternate source of income like Social Security, alimony, or retirement income.

- Credit check: Some lenders will require a minimum credit score before lending you money.

- Minimum age: You’ll typically need to be at least 18 to qualify for a loan.

- Identification: You’ll need some kind of government-issued photo ID with your full legal name and date of birth. Common options include a state ID, driver’s license, or passport.

- Proof of residency: You might need documentation verifying your citizenship and residency status. This could include a leasing agreement or utility bills. If you are not a resident of the state in which the lender operates, you might not be able to get a loan.

- SSN or ITIN: Some lenders require your Social Security Number or Individual Taxpayer Identification Number.

- Contact information: You’ll typically need a physical address, email address, and phone number.

- Maximum debt-to-income ratio (DTI): Your DTI is the percentage of your gross monthly income that pays your monthly debts. Some lenders will have a maximum DTI — say, 40% — requirement. If your DTI is higher than that, you might not qualify.

Before applying for a loan, read through the lender’s requirements carefully to make sure you qualify. If you do not qualify, you may need to consider alternative loan options or a different lender.

What to Look for in an Emergency Loan Lender

Every lender is different. So, even if you need emergency cash, it’s still important to find the right lender for your situation. As you consider several lenders for your financing needs, here are some questions to ask yourself before applying:

- What types of lender fees do they have (e.g., origination fees, application fees, prepayment penalties, etc.)?

- What are their typical interest rates?

- Which loan options are available?

- What are the minimum and maximum loan amounts?

- What are the standard repayment terms, and are they flexible?

- Do you meet their general loan requirements?

- What’s the application process like, and how long does it take to receive funds?

- Is the lender licensed to operate in your state?

- Are there any limitations on how you can use the loan?

- Does the loan require collateral (secured) or not?

- What’s the lender’s online reputation and customer service like?

If you need money fast, consider Jora.

We offer installment loans and personal lines of credit to borrowers with bad or fair credit. Our online application process is streamlined and only takes a few minutes to complete. If you apply and accept your loan prior to 10:30 a.m. Central time (Monday - Friday, excluding bank holidays), you could receive the funds in your bank account the same day you apply.*

The last thing you need when facing a financial crisis is to worry about making payments on a loan. That’s why it’s so important to ensure you can comfortably afford a loan before taking one out.

To do this, use an online calculator to determine how much the loan will cost each month and in total. Once you estimate the monthly payment amount, review your budget to see if you can make the payments. If you can, you’ll have a higher chance of being able to afford the loan. If you cannot, you might need to consider an alternative solution or apply for a smaller loan with lower payments.

Some lenders, like Jora, offer flexible repayment plans so that you can more easily afford to pay back your loan. You can make payments over time until the balance is paid off. Or you can pay back the loan early without a prepayment penalty to save on interest charges.

The best loans for bad credit are those with zero hidden fees, flexible repayment options, and minimal requirements. Some lenders will still require a credit check, but this does not necessarily mean the lender or their loan options are bad. As long as the lender also considers other criteria — like your income or debt-to-income ratio — when making their decision, it could still be a good option for you.

On the FICO scoring model, your credit score ranges from 300 to 850. A credit score of 670 or higher is considered good credit, while anything below 670 is considered fair or poor credit. The higher your score is, the lower the risk you are to lenders. With good credit, you could qualify for more types of financing, potentially with lower interest rates and higher loan amounts.

The answer depends on what you need. Payday loans could be a good option if you need cash now and do not have good credit. However, these short-term loans come with very short repayment terms and high financing fees. This makes it difficult for borrowers to pay back what they owe — plus the fees — on time.

If you need more time to repay your loan, an installment loan may be better. These loans also tend to come in higher amounts, making them a good option for more expensive financial emergencies.

You can get an emergency loan from an in-person or online lender, such as a bad credit installment loan direct lender. You might also be able to get one from a credit union or a bank, though the application and funding process may be longer than if you were to go with an online lender.