Are you facing a financial emergency in Missouri? A payday loan or its alternatives can quickly provide the cash needed to cover unexpected expenses. In this article, we explore why people choose payday loans in Missouri, the requirements for obtaining one, and how to apply for a payday loan alternative like Jora Credit.

Understanding Payday Loans in Missouri: What Are They?

Payday loans are short-term loans that come with fast approval and funding times. They’re sometimes called cash advance loans, fast loans, no-credit-check loans, or small loans.

Unlike most installment or other personal loans, payday loans are usually just $500. Most payday direct lenders do not require a credit check or a lengthy application process either, making them a popular option for borrowers with bad credit or those who don’t qualify for traditional credit.

You can apply for a payday loan via an online or storefront lender. To find a lender, search for things like “payday loans near me in Missouri,” “bad-credit loans in Missouri,” or “online loans for bad credit in Missouri.”

After the lender approves the loan, you’ll generally receive the money via cash, check, prepaid debit card, or electronic deposit to your connected bank account. You must then repay the total amount — plus interest or any financing fees — by your next payday (usually between 14 and 31 days).

Once you take out a payday loan, you’ll have several ways to repay it. One way is to write a postdated check for the full amount owed (including fees). Another option is to authorize an electronic debit through your bank account. When the loan comes due, the payday lender can debit the funds from your account or cash the check.

Most payday loans do not come with a prepayment penalty. This means you can pay back the loan early without incurring additional fees. The problem is that the short repayment period can make it harder to pay back the debt on time. That’s why it’s essential to make sure you have a plan to repay the loan before taking one out.

Payday loans are not legal in every state, but they are legal in Missouri. However, payday lenders must follow specific rules and regulations to operate in the state.

For example, payday direct lenders hold a license from the Missouri Division of Finance. Payday loans cannot have a repayment term of less than 14 days and capped at $500.

In addition, payday lenders can only renew a payday loan up to six times. Lenders must also adhere to certain interest rate and fee limits and clearly list these fees so that any potential borrower knows what they are before accepting a loan. Remember that Missouri’s payday lending laws may change at any time. You can check the current status and regulations on the Office of the Attorney General in Missouri’s website or visit the National Conference of State Legislatures for an overview of payday lending.

Getting a payday loan in Missouri is relatively easy, making it a popular credit solution for borrowers who need quick cash now. Each payday loan lender has their own requirements, but these are the typical lending criteria in Missouri:

- Proof of identity: You may be required to show a valid government-issued ID, like a driver’s li`cense or passport. This ID should include a clear photograph and your current address. You might also need your Social Security number.

- Minimum age: You must have reached the age of majority, which is 18 years old in Missouri.

- Proof of income: Although you do not necessarily need a job to get a payday loan, you must provide proof of sufficient income. Commonly accepted forms of income include alimony, recent paystubs, W2s, bank statements, employment letters, and federal income tax returns.

- Bank account: You’ll typically need a bank account in your name to apply for a loan. Lenders may disburse and debit funds from this account.

- Other contact information: Along with your address, you may also need to provide your phone number and email address.

- Direct deposit: Some payday lenders require you to have direct deposit set up with your current employer.

Payday loans are a type of no-credit-check loan, meaning most lenders will not check your credit score when you apply. This means you could qualify for a loan even with bad credit or limited credit history.

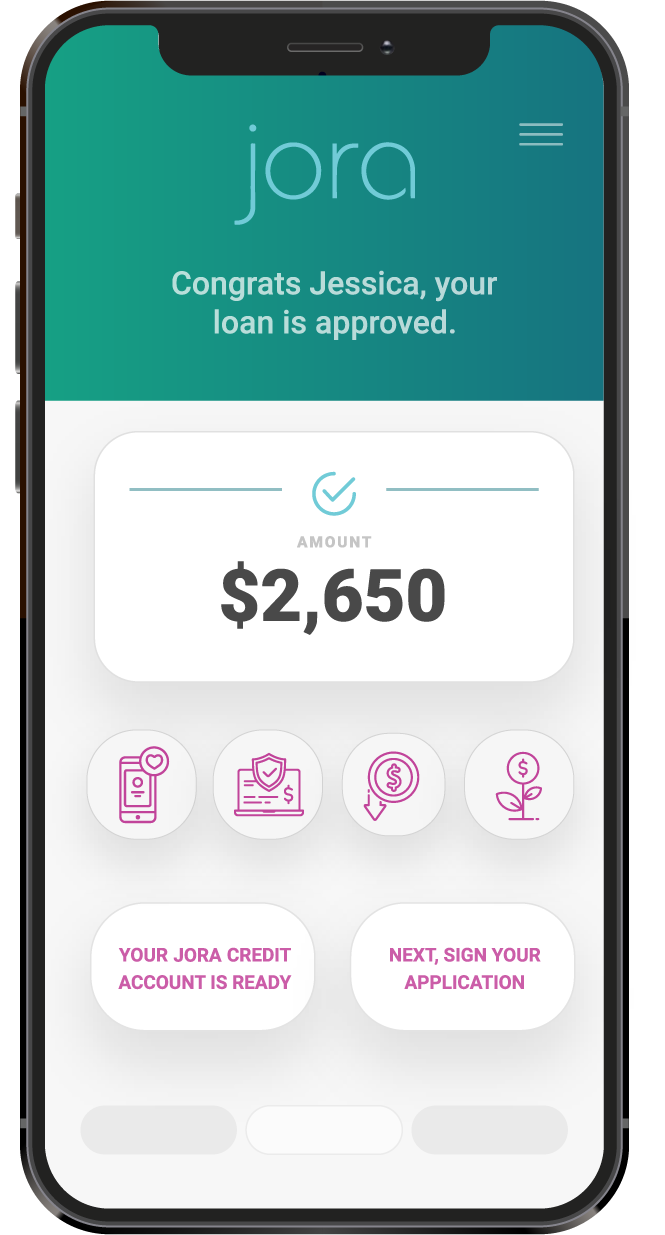

Some installment loan direct lenders, like Jora, who are not payday lenders, also offer credit to borrowers with bad credit. The application process is quick, and easy. If approved, you could receive up to $4,000 the same day you apply.*

Why Jora Credit?

Payday loans can be beneficial if you’re in a financial bind, need cash fast, or do not want to deal with a complicated application process. However, these loans come with their share of drawbacks.

Consider the following pros and cons before choosing a payday loan over another option — like unsecured personal loans or installment loans.

Pros:

- Quick Access to Funds: One of the most significant advantages of payday loans is their rapid processing time. Most payday loan providers can disburse funds within a few hours or by the next business day, which can be crucial for addressing emergency financial needs.

- Minimal Requirements: Unlike traditional loans, payday loans typically require less documentation and have more relaxed credit requirements. This makes them accessible to individuals with poor credit history or those who may not qualify for other types of credit.

- Local and Online Options: In Missouri, payday loans are widely available through both physical storefronts and online lenders, providing flexibility and convenience for borrowers.

- No Collateral Required: Payday loans are unsecured, meaning you don't have to put up any personal property or assets as collateral, reducing the risk of losing valuable assets.

Cons:

- High Interest Rates and Fees: Payday loans are notorious for their high interest rates and fees. In Missouri, lenders can charge significant amounts in interest, making the overall cost of borrowing much higher than other types of credit.

- Short Repayment Terms: Payday loans must be repaid within a few weeks, often by your next paycheck. This short repayment period can lead to financial strain, especially if you cannot repay the loan on time.

- Potential Debt Cycle: If borrowers can't repay the loan on time, they might be tempted to roll over the loan, which incurs additional fees and interest. This can lead to a difficult-to-escape debt cycle.

- Negative Impact on Credit Score: While payday lenders typically do not report positive payment history to credit bureaus, defaulting on a payday loan can lead to collection actions that negatively impact your credit score.

- Small Loan Sizes: Payday loans in Missouri are generally for small amounts, which might not be sufficient to cover larger financial needs. Borrowers seeking larger sums may need to look for alternative loan options.

Payday loans are a convenient way to deal with financial emergencies in Missouri, but they are not your only option. Here are some alternatives to these loans:

- Payday Alternative Loans (PALs): Offered through credit unions, PALs come in higher amounts up to $2,000. Most PALs have a repayment term of one to 12 months. You’ll typically need to be a credit union member before applying.

- Cash advance apps: These apps let you borrow against your upcoming paycheck a few days early. You can usually only borrow a small amount. Some apps have a subscription or tipping model, while others are free. You may need to have direct deposit set up to qualify.

- Family or friend loan: If you need cash quickly, you can ask a friend or family member for a loan. This way, you can skip the loan application process and get the funds you need sooner. Just make sure that the loan terms are clear to everyone involved.

- Payment plan: If you’re dealing with medical bills, you might be able to set up a payment plan with the hospital or doctor’s office. This lets you spread out payments over a set amount of time, which can lower the financial burden.

- Other bad-credit or no-credit-check loans: Missouri’s pawnshop, title, and other bad-credit loans are designed to help in emergencies. Each loan has its own requirements and fees, though. For example, you’ll need to put up collateral with some loans, such as pawnshop or title loans. Failure to pay back the loan could mean losing your possession.

Installment loans are another option to consider. Certain direct cash lenders who are not payday lenders, like Jora, offer these loans to borrowers with poor credit. The application process is simple. If the lender approves your application and you accept the loan terms before 10:30 a.m. CST, you could receive up to $4,000 the same day you apply.*

Jora does not charge any hidden fees. You can even repay the money you borrow early without a prepayment penalty. And, unlike with payday loans, you have more time to repay what you owe.

No, payday loans are not intended for long-term use. They have very short repayment terms and high interest rates and fees. Because of this, they’re best for temporary or one-time emergencies.

Payday loans are a type of unsecured loan. This means you do not need to put up collateral to get a loan. However, you will still need to repay the loan, plus any late fees or other charges.

This depends on your needs and financial situation. You might have better luck getting a payday loan if you have bad credit or limited credit history. However, some installment loan lenders offer financing for bad credit borrowers. You might also want an installment loan if you need more flexible repayment options or larger loan amounts.

At Jora Credit, we understand the importance of providing customers with a seamless and efficient borrowing experience. Our alternative loan option, unlike payday loans in Missouri, is designed to help individuals with bad credit get the funds they need. With our fast decision process and same-day funding, we strive to make the borrowing process as convenient as possible. Apply today and experience the benefits of choosing Jora Credit for your alternative loan needs.